Weekly Data

WHAT THE DATA SAY: 3 in 4 considering 'dupe destinations' to save on summer travel

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

SCHOOL’S OUT AND SO ARE TEACHERS’ SAVINGS

School’s out for summer, and the majority (61%) of American teachers are stressed about their finances – with many looking for a second job or considering leaving their job for one that pays more, according to our Harris Poll research with DailyPay.

- 42% of teachers say they find it challenging to pay bills on time.

- 27% say they ran out of money between paychecks in the past year.

- 22% say they had to secure a second job or side hustle to make ends meet.

- 27% say they have considered leaving their current job for one that pays more.

- 70% of teachers say it would be helpful to be paid more frequently than twice per month.

THE ROAD LESS TRAVELED – TO SAVE MONEY

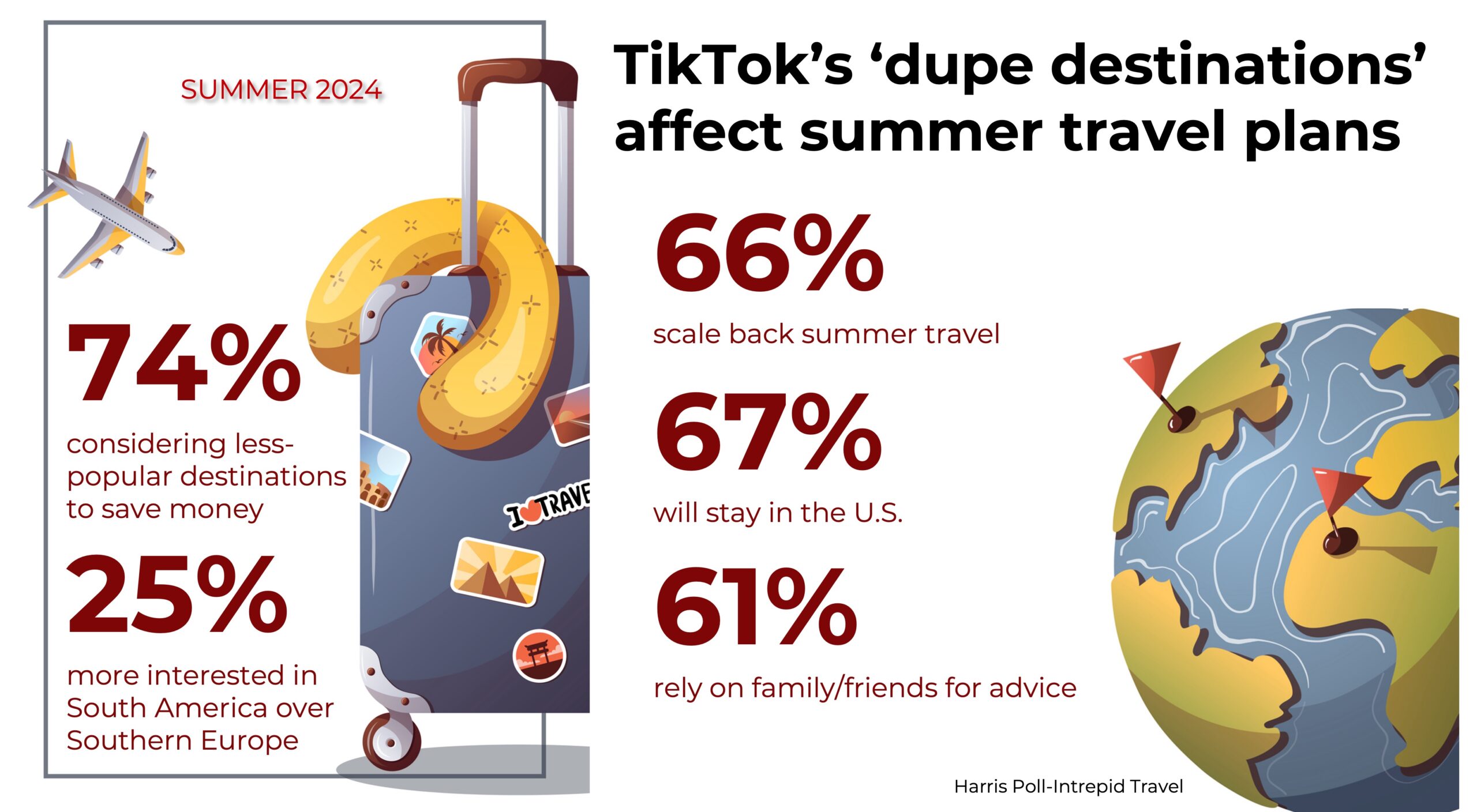

8 in 10 Americans (84%) are planning to travel this summer, yet 66% say the economy has forced them to scale back or “swap” travel plans, according to our Harris Poll survey with Intrepid Travel.

- For 74% of those surveyed, “summer swaps” or “dupe destinations” popularized on TikTok are now the plan, as travelers seek out less-trodden alternatives to popular hot spots to save money.

- 64% plan to take a trip with family.

- 42% will seek a new destination, while 40% will take a repeat vacation.

- 67% will travel within the United States.

- 25% report less interest in traveling to classic Southern European summer destinations like Italy and France and are, instead, swapping out for South America.

- When it comes to the best advice on where to vacation, 61% rely on recommendations from friends and family.

- 54% believe generative AI could be a game changer for vacation planning in the future, with 25% already using AI for travel.

- SEE ALSO: Have points, will travel: Survey shows generational and gender differences in how Americans vacation

WHAT’S IN YOUR WALLET?

Older Americans tend to use credit as a strategy for racking up points, while young people are using it to get by, based on our new Harris Poll survey with NerdWallet.

- 44% of Boomers use credit cards to accumulate rewards or cash back.

- 22% of Gen Z and Millennials use a credit card to pay for necessities, such as groceries and bills, because they do not have enough cash on hand.

- 27% carry a monthly balance on at least one credit card.

- 33% feel better about their ability to manage their debt now than they did a year ago.

- Yet 58% of Gen Z and 57% of Millennials have been charged a late fee in the past year (versus 32% of Gen X and 13% of Boomers).

ICYMI

In case you missed it, check out some of the thought-leadership and happenings around Stagwell making news:

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…