By

CONTACT

hello@stagwellglobal.com

SIGN UP FOR OUR INSIGHTS BLASTS

7 takeaways following Stagwell’s second-quarter report, including how creativity and media agencies are joining forces

S4 recently reduced its full-year earnings estimates and paused hiring. What are your thoughts about that?

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

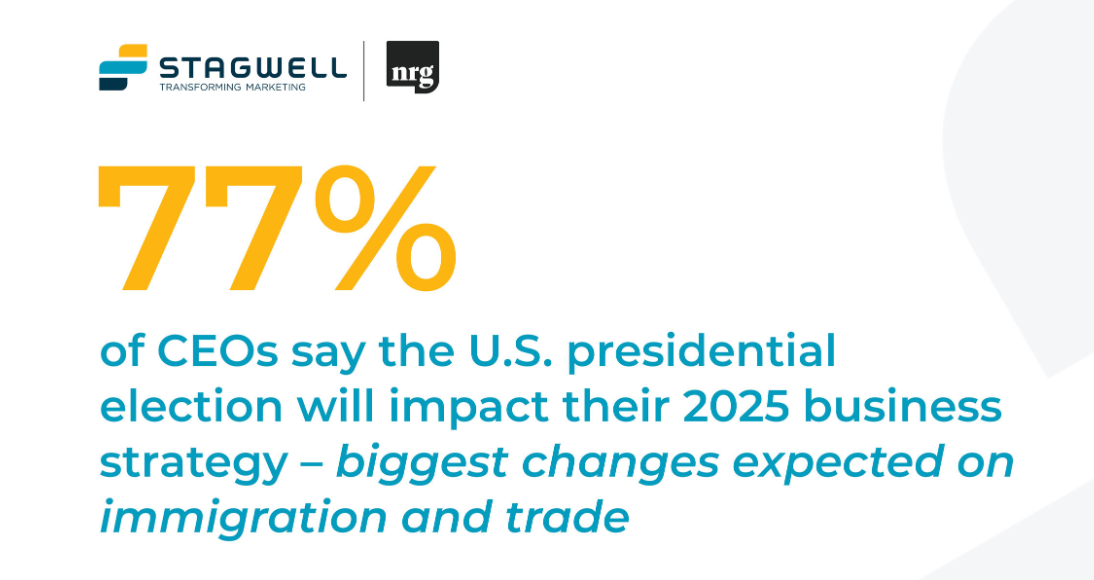

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Thought Leadership

Jun 28, 2024

Hitting the Mark: Future of News Takeaways from Cannes Lions

Stagwell brought the Future of News to Cannes Lions, where…

Newsletter

Sign Up

Originally released on

Delivers Double-Digit 2Q 2022 Revenue Growth; Reiterates guidance driven by global media performance and continued digital acceleration

- 2Q GAAP Revenue grew 221.1% and 21.2% on a Pro Forma basis; YTD Pro Forma growth of 26.0%

- Pro-Forma Organic Net Revenue grew 16.0% in 2Q and 19.1% YTD

- Net Income of $24.5M in 2Q and Diluted EPS of $0.08 per share

- Net Income attributable to Stagwell of $10.5M in 2Q

- Adjusted EBITDA of $111.3M in 2Q representing a 20.0% margin on Net Revenue

- 57% of 2Q Net Revenue came from high-growth digital services

- Reaffirming 2022 full-year organic net revenue growth outlook of 18%-22%

New York, NY, August 4, 2022 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three and six months ended June 30, 2022.

SECOND QUARTER AND YTD HIGHLIGHTS:

- Second quarter revenue of $672.9 million, an increase of 221.1% versus the prior year period; YTD revenue of $1,315.8 million, an increase of 236.7% versus the prior year period.

- Second quarter Pro Forma GAAP revenue growth of 21.2% versus the prior year period and 19.3% ex-Advocacy; YTD Pro Forma GAAP revenue growth of 26.0% versus the prior year period and 24.4% ex-Advocacy

- Second quarter net revenue of $556.3 million, an increase of 205.9% versus the prior period; YTD net revenue of $1,083.0 million, an increase of 218.6% versus the prior year period.

- Second quarter Pro Forma net revenue growth of 15.8% versus the prior year period and 14.6% ex-Advocacy; YTD Pro Forma net revenue growth of 19.1% versus the prior year period and 18.3% ex-Advocacy

- Second quarter Pro Forma organic net revenue growth of 16.0% versus the prior year period and 14.8% ex-Advocacy; YTD Pro Forma organic net revenue growth of 19.6% versus the prior year period and 18.8% ex-Advocacy.

- Second quarter net income of $24.5 million versus $18.7 million in the prior year period; YTD net income of $58.1 million versus $23.3 million in the prior year period.

- Second quarter net income attributable to Stagwell Inc. common shareholders of $10.5 million versus $17.3 million in the prior year period; YTD net income attributable to Stagwell Inc. common shareholders of $23.1 million versus $21.7 million in the prior year period.

- Second quarter adjusted EBITDA of $111.3 million, an increase of 187.5% versus the prior year period; YTD adjusted EBITDA of $212.7 million, an increase of 240.0% versus the prior year period.

- Pro Forma adjusted EBITDA growth of 13.0% versus the prior period and 11.4% ex-Advocacy; YTD adjusted EBITDA growth of 22.0% versus the prior period and 20.5% ex-Advocacy.

- Second quarter Adjusted EBITDA Margin of 20.0% of net revenue; YTD Adjusted EBITDA Margin of 19.6% of net revenue.

- Net New Business wins totaled $31 million in the quarter.

“Stagwell is executing exactly as we said we would, and doing so profitably. We delivered significant organic net revenue growth of 16% in the second quarter, which has the toughest comparisons of the year. Our high-growth digital capabilities expanded to 57% of net revenue and grew 28% organically versus the prior year period. Due to our unique mix of digital and creative capabilities, clients now recognize Stagwell as a serious alternative to legacy incumbents – and we are now a regular contender in many of the largest global pitches,” said Mark Penn, Chairman and Chief Executive Officer of Stagwell. “Our disciplined financial management and strong cost controls allow us to maintain leading margins, even while making smart investments in our corporate infrastructure to scale the network. We are optimistic about the back half of the year as our world-class advocacy businesses prepare for a record cycle of US political advertising spend and our year-over-year comparisons ease. We remain very confident in our full-year guidance of 18-22% organic net revenue growth and $450-$480 million of adjusted EBITDA.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported strong second quarter results with GAAP revenue of $673 million, net revenue of $556 million and Adjusted EBITDA of $111 million. Pro forma organic net revenue increased 16% over the prior period and Adjusted EBITDA margins remained strong at 20% of net revenue as we remain diligent around cost controls. Our balance sheet is in a good position and should benefit as we head into the seasonally strong back half of the year when we expect cash flow to increase significantly.”

FINANCIAL OUTLOOK

2022 financial guidance is as follows:

- Pro Forma Organic Net Revenue growth of 18% – 22%

- Pro Forma Organic Net Revenue growth ex-Advocacy of 13% – 17%

- Adjusted EBITDA of $450 million – $480 million, excluding the contribution from 2022 acquisitions

- Pro Forma Free Cash Flow growth of approximately 30%

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

| * The Company has excluded a quantitative reconciliation with respect to the Company’s 2022 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

CONFERENCE CALL

Management will host a video webcast and conference call on Thursday, August 4, 2022, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three and six months ended June 30, 2022. The video webcast will be accessible at https://bit.ly/STGWEarningsQ2. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

STAGWELL INC.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 13,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

BASIS OF PRESENTATION

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statements of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entirety of all periods presented.

NON-GAAP FINANCIAL MEASURES

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(5) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This press release contains forward-looking statements. Statements in this press release that are not historical facts, including without limitation the information under the heading “Financial Outlook” and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Some of the factors that could materially and adversely affect our business, financial condition, results of operations and cash flows include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- the continued impact of the coronavirus pandemic (“COVID-19”), and evolving strains of COVID-19 on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities;

- the Company’s material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

NEW YORK – July 14, 2022 – Stagwell, the challenger network built to transform marketing, today shared that Moody’s Investors Service (Moody’s) has upgraded the company’s corporate family rating to B1 from B2. Additionally, Moody’s upgraded the profitability of default rating to B1-PD from B2-PD, senior unsecured notes rating to B2 from B3, and speculative grade liquidity rating to SGL-2 from SGL-3. Given the upgrade, the outlook was also changed to stable from positive.

In a release from Moody’s, Peter Adu, Moody’s Vice President and Senior Credit Officer commented on this upgrade saying that, “The upgrade reflects the company’s good operating momentum post-merger and its focus on deleveraging.”

The full release from Moody’s can be found here.

“This week’s upgrade is a positive development for Stagwell, reflecting the financial and operational transformation our corporate leaders have steered as we near the one-year anniversary of Stagwell’s formation,” said Mark Penn, Chairman and CEO, Stagwell.

Stagwell will report financial results for the three months ended June 30, 2022, on Thursday, August 4, before market open. Register for the earnings webcast at 8:30 AM E.T. the same day.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 12,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contact:

Press:

Beth Sidhu

pr@stagwellglobal.com

(202) 423-4414

Investors:

Michaela Pewarski

ir@stagwellglobal.com

(646) 429-1812

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

PEP Group joins Locaria to rapidly extend multilingual media and content production capabilities within Stagwell

NEW YORK and LONDON, July 13, 2022 – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced the acquisition of PEP Group, an omnichannel content creation and adaptation production company. In response to the explosion in new media channels that require a streamlined and scalable approach to producing multi-market assets, PEP Group will join Locaria, Stagwell’s multilingual content agency, to bolster its media and content production capabilities across its global network.

PEP Group is an established provider of design, creative, production and asset management for leading brands including Kimberly-Clark, Colgate-Palmolive, and Church & Dwight.

Locaria’s digital-first multilingual content offering has resonated with modern international marketers, delivering exceptional year-over-year growth. The agency’s global proposition is built on its deep understanding of local market nuances coupled with digital marketing expertise to ensure content is adapted properly, scaled internationally and optimized for the best performance. PEP Group will enhance Locaria’s ability to offer multi-market post-production, adaptation and asset deployment at scale.

“Locaria has been sending a message to marketers for years that multilingual content and localization can no longer be an afterthought. By acquiring PEP Group, we’re doubling down at Stagwell on scaled content offerings that empower global brands to connect meaningfully with consumers, anywhere,” said Stagwell Chairman and CEO Mark Penn.

“PEP Group’s production leadership and delivery expertise mean we can better partner with advertisers across all aspects of marketing content production, from research and insights through production, to media activation and optimization, delivering even greater value to our clients around the world,” said Locaria CEO Hannes Ben.

PEP Group complements Locaria’s global footprint across EMEA, LATAM and APAC. Headquartered in Kyiv, Ukraine, with offices in Canada and The Netherlands, PEP Group has continued to meet global production demands, with all team members affected by the crisis in Ukraine working from other locations to provide continuity to clients and partners.

“Our manifesto is, ‘There’s not a production problem we cannot solve.’ Now, I’m excited to solidify our offering, grow the team and add value as a complement to Locaria’s omnichannel marketing expertise and extensive global reach,” said PEP Group Founder Mikhail (Misha) Pimenov.

“I’m thrilled to welcome Misha and his expert team to Locaria. By breaking down traditional silos and bringing together production and localization, we can now offer more engaging international content and greater efficiencies,” said Locaria COO Lindsay Hong. “It’s great that we have been able to execute this deal despite the ongoing conflict so that clients can continue to benefit from expert Ukrainian talent.”

Pimenov will stay on at Locaria as EVP – Creative Content.

The acquisition will also enhance Locaria’s proprietary workflow technologies Locate, a cloud-based content delivery platform, and Prism, a dedicated client-review portal.

Terms were not disclosed.

About Locaria

Locaria is a global multilingual content agency which specialises in supporting in-house marketing and ecommerce teams, media agencies and creative production houses. We build linguistic solutions to scale content and campaigns internationally, while carefully balancing efficiency, effectiveness, creativity and quality.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 12,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

For Locaria:

Gunilla Huddleston

gunilla.huddleston@locaria.com

For Stagwell:

Beth Sidhu

202-423-4414

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

NEW YORK – July 7, 2022 – Stagwell (NASDAQ: STGW) announced today the Company will report financial results for the three months ended June 30, 2022, on Thursday, Aug. 4, before the market open.

Stagwell will host a webcast to review those results the same day at 8:30 a.m. EDT. To register and view the webcast, visit this link.

A replay of the webcast will be available following the event at Stagwell’s website, https://www.stagwellglobal.com/investors/.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 12,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

IR Contact:

Michaela Pewarski

646-429-1812

PR Contact:

Beth Sidhu

202-423-4414

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

Chariman and CEO Mark Penn to Participate in a Fireside Chat

NEW YORK and BOSTON, May 13, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will attend the upcoming J.P. Morgan 50th Annual Global Technology, Media and Communications Conference, taking place May 23-25 in Boston. Penn will participate in a fireside chat with Q&A to follow. The session will take place at 3:50 p.m. EDT on Monday, May 23. To register and access the presentation, please visit this link.

Penn will also be available for 1:1 investor meetings. For more information, please reach out to ir@stagwellglobal.com.

Stagwell reported Q1 2022 earnings on Friday, May 6, and released its 2021 Annual Report on Monday, May 2.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contact: Michaela Pewarski

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

In the News, Press Releases

Dec 02, 2024

Ray Day Assumes Role of Executive Chairman at Allison Worldwide; Co-Founders Scott Allison and Andy Hardie-Brown Stepping Down

Newsletter

Sign Up

Originally released on

NEW YORK, May 9, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW) announced today that Chairman and CEO Mark Penn will attend the upcoming Needham Technology & Media Conference on Monday, May 16, and Tuesday, May 17. Penn will deliver a virtual presentation at 12:45 EDT on Monday, May 16. To register and access the presentation, please visit this link.

Penn will also be available for 1:1 investor meetings virtually on May 16 and in person on May 17. For more information, please reach out to ir@stagwellglobal.com.

Stagwell reported Q1 2022 earnings on Friday, May 6, and released its 2021 Annual Report on Monday, May 2.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contact: Michaela Pewarski

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

In the News, Press Releases

Dec 02, 2024

Ray Day Assumes Role of Executive Chairman at Allison Worldwide; Co-Founders Scott Allison and Andy Hardie-Brown Stepping Down

Newsletter

Sign Up

Originally released on

FEATURING

Record first quarter financial results driven by high-growth digital transformation, consumer insights & strategy, and large client wins in media

-

GAAP Revenue grew 254.7% in 1Q and 31.5% on a Pro Forma basis

-

Pro-Forma Organic Net Revenue grew 23.6% in 1Q

-

Net Income of $33.6M in 1Q or Diluted EPS of $0.10 per share

-

Net Income attributable to Stagwell of $12.7M in 1Q

-

Adjusted EBITDA of $101.4M in 1Q representing a 19.3% margin on Net Revenue

-

Record first quarter Net New Business of $54M

-

56% of 1Q Net Revenue came from high-growth digital services

-

Reaffirms 2022 full-year outlook

New York, NY, May 6, 2022 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three months ended March 31, 2022.

FIRST QUARTER HIGHLIGHTS:

- Revenue of $642.9 million, an increase of 254.7% versus the prior year period.

- Pro Forma GAAP revenue growth of 31.5% versus the prior year period and 30.2% ex-Advocacy.

- First quarter net revenue of $526.6 million, an increase of 233.2% versus the prior period.

- Pro Forma net revenue growth of 22.8% versus the prior year period and 22.3% ex-Advocacy.

- Pro Forma organic net revenue growth of 23.6% versus the prior year period and 23.2% ex-Advocacy.

- First quarter net income of $33.6 million versus $4.6 million in the prior year period.

- First quarter net income attributable to Stagwell Inc. common shareholders of $12.7 million versus $4.4 million in the prior year period.

- First quarter adjusted EBITDA of $101.4 million, an increase of 325.4% versus the prior year period.

- Pro Forma adjusted EBITDA growth of 33.8% versus the prior period and 32.4% ex-Advocacy.

- First quarter Adjusted EBITDA Margin of 19.3% of net revenue.

- Net New Business wins totaled $54 million in the quarter.

“While the GDP may be contracting, Stagwell is growing strongly. The merger has spurred revenue synergies immediately apparent in the big wins, significant industry awards, and integration of talent and technology across our network,” said Mark Penn, Chairman and Chief Executive Officer of Stagwell. “We grew first quarter net revenue 24% versus the prior year, more than double the pace of legacy holding companies, and grew Adjusted EBITDA at an even faster rate of 34% year-over-year. We also made a key e-commerce acquisition in April with Brand New Galaxy, which connects to our media and digital transformation offerings and provides increased scale in Europe. Our record quarter continues to build on our post-combination track record of delivering growth, free-cash-flow, and growing profitability.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported strong first quarter results with GAAP revenue of $643 million, net revenue of $527 million and Adjusted EBITDA of $101 million. Organic pro forma net revenue increased 24% over the prior period quarter and also increased sequentially in a typically smaller seasonal quarter. Adjusted EBITDA margin expanded 160 bps year-over-year on a Pro Forma basis to 19.3% of net revenue as the Company began to see the benefits of expected cost synergies.”

Financial Outlook

2022 financial guidance is as follows:

- Pro Forma Organic Net Revenue growth of 18% – 22%

- Pro Forma Organic Net Revenue growth ex-Advocacy of 13% – 17%

- Adjusted EBITDA of $450 million – $480 million, excluding the contribution from 2022 acquisitions

- Pro Forma Free Cash Flow growth of approximately 30%

- Guidance assumes no impact from foreign exchange, acquisitions or dispositions.

| * The Company has excluded a quantitative reconciliation with respect to the Company’s 2022 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Conference Call

Management will host a video webcast and conference call on Friday, May 6, 2022, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three months ended March 31, 2022. The video webcast will be accessible at https://stagwellq12022earnings.open-exchange.net/. An investor presentation has been posted on our website at www.stagwellglobal.com and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Basis of Presentation

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statements of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entirety of all periods presented.

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc. has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(5) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This press release contains forward-looking statements. Statements in this press release that are not historical facts, including without limitation the information under the heading “Financial Outlook” and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Some of the factors that could materially and adversely affect our business, financial condition, results of operations and cash flows include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients;

- the effects of the coronavirus pandemic (“COVID-19”), and the impact on the economy and demand for the Company’s services, which may precipitate or exacerbate other risks and uncertainties;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- the Company’s ability to attract new clients and retain existing clients;

- the impact of a reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to compete in the markets in which it operates;

- the Company’s ability to achieve its cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the Company’s ability to manage its growth effectively, including the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities;

- the Company’s material weaknesses in internal control over financial reporting and its ability to establish and maintain an effective system of internal control over financial reporting;

- the Company’s ability to protect client data from security incidents or cyberattacks;

- economic disruptions resulting from war and other geopolitical tensions (such as the ongoing military conflict between Russia and Ukraine), terrorist activities and natural disasters;

- stock price volatility; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in our 2021 Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on March 17, 2022, and accessible on the SEC’s website at www.sec.gov, under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

NEW YORK – May 3, 2022 – Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today released its 2021 Annual Report, highlighting substantial growth propelled by a uniquely high concentration of digital capabilities; strategic investments and acquisitions supporting digital and global growth; and a collaborative organizational model designed to meet the demands of larger clients in need of true integrated marketing services. Download the report here.

“In a digital economy, every screen is a canvas, every experience a data collection point, and every platform a new place for brand interaction. Brands deserve a digital-first alternative marketing network that drives business growth by connecting culture-moving creativity with leading-edge technology,” said Stagwell Chairman and CEO Mark Penn. “We strongly believe the steps we have taken to align Stagwell’s operations to support this transformation created a lasting platform for growth and shareholder value.”

Stagwell has had breakthrough performance since the combination with MDC Partners Inc., forming Stagwell Inc. in August 2021. This includes $2 billion in combined pro forma revenue for 2021. Penn’s annual CEO letter discusses Stagwell’s 2021 financial performance in the context of five transformative approaches to global marketing services delivery:

- Digital transformation and innovation, helping clients reposition their enterprises for growth in the new digital economy. Innovation shops Code and Theory, GALE, Instrument, and YML spotlight path-breaking work for Amazon Ads, MilkPEP, Google TV, Polestar and more within the report.

- Scaling creative performance for modern brands, bringing world-class creativity and modern media together to drive powerful campaign results. Work from 72andSunny for Tinder/Match Group; Anomaly for Expedia; Assembly for Nike; Doner for CUE Health; Forsman & Bodenfors for Polestar; and more illustrate ways Stagwell unleashes creative effectiveness for the modern marketer.

- Building integrated marketing solutions that align the right mix of core marketing capabilities and specialist expertise for ever-more-complex clients, exemplified in Sloane & Co., KWT Global, TEAM Enterprises, and GALE’s collaborative marketing efforts supporting Hertz’s vision for the future of electric vehicles.

- Agile global expansion, fueled by Stagwell’s Affiliate Program spanning 50+ partners across Latin America, the Middle East, Africa, Asia-Pacific, and Eastern Europe, and investments in market leaders Instrument and Goodstuff.

- Product innovation through the Stagwell Marketing Cloud, a proprietary product suite of SaaS and DaaS solutions that leverage artificial intelligence, machine learning, and mixed-reality business transformation for in-house marketers. SMC’s services span audience segmentation, influencer marketing, public relations, immersive experiences, and brand insights. The newest platform in the Cloud, ARound, helps brands create, manage, and scale augmented reality experiences for live events and retail.

To read the full report, please visit Stagwell’s website. Viewers can use QR codes throughout the document to explore referenced case studies.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

PR Contact:

Beth Sidhu

pr@stagwellglobal.com

+1. 202.423.4414

IR Contact:

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Nov 25, 2024

Stagwell (STGW) Announces December Investor Conference Schedule

In the News, Investments & Financials, Press Releases

Nov 07, 2024

STAGWELL INC. (NASDAQ: STGW) REPORTS RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

In the News, Investments & Financials, Press Releases

Oct 10, 2024

Stagwell (STGW) Schedules Webcast to Discuss Financial Results for the Three Months Ended September 30, 2024

Newsletter

Sign Up

Originally released on

NEW YORK, March 23, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced its Board of Directors has authorized a stock repurchase program (the “Repurchase Program”) under which it may repurchase up to $125.0 million of shares of its outstanding Class A common stock. The Repurchase Program will expire on March 23, 2025.

Under the Repurchase Program, share repurchases may be made at the Company’s discretion from time to time in open market transactions at prevailing market prices (including through trading plans that may be adopted in accordance with Rule 10b5-1 of the Securities Exchange Act of 1934, as amended), in privately negotiated transactions, or through other means. The timing and number of shares repurchased under the program will depend on a variety of factors, including the performance of the Company’s stock price, general market and economic conditions, regulatory requirements, the availability of funds, and other relevant considerations, as determined by the Company. The Repurchase Program may be suspended, modified or discontinued at any time without prior notice. The Company’s Board of Directors will review the Repurchase Program periodically and may authorize adjustments of its terms if appropriate.

“This program reinforces the confidence of Stagwell’s Board in our financial strength, the transformative results of our combination, and the rigorous strategic management our team has applied to the business,” said Mark Penn, Chairman and CEO, Stagwell.

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Forward-Looking Statements

This press release contains forward-looking statements. The forward-looking statements in this release include statements regarding the Company’s stock repurchase program and expectations regarding such program and the Company’s ability to repurchase shares thereunder. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors that could adversely affect the Company’s business, financial condition, results of operations and cash flows, including those outlined in the Company’s Annual Report on Form 10-K, and the Company’s other filings with the Securities and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events.

Contact:

Michaela Pewarski

IR@stagwellglobal.com

646-429-1812

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

In the News, Press Releases

Dec 02, 2024

Ray Day Assumes Role of Executive Chairman at Allison Worldwide; Co-Founders Scott Allison and Andy Hardie-Brown Stepping Down