Via Adweek, Stagwell, Getty Images.

Today Stagwell Inc. announced record full-year 2021 financial results and growth in the fourth quarter.

Stagwell’s total revenue in the fourth quarter was $611.9 million, up 95.5% from the same period last year. Its full-year 2021 revenue was nearly $1.5 billion, up 65.5% compared to the previous year. Fourth quarter net revenue reached $519.7 million, an increase of 160.9% versus the prior period, while the company’s full-year net revenue of almost $1.3 billion is an increase of 100.4% compared to last year. The company’s pro forma organic net revenue was up 11.3% in the fourth quarter and 14.5% for the year.

Stagwell merged with MDC Partners in August 2021. The pro forma revenue calculation assumes that the company solidified its merger with MDC at the beginning of 2021, instead of in August 2021. Today’s earnings announcement is the company’s second as a combined entity.

“Today’s results demonstrate that the merger is not only working, but is working even better and faster than expected,” said Stagwell chairman and CEO Mark Penn in a call with analysts.

Three key factors, the leader said, propel the business forward: its high concentration of digital capabilities, its scale in new markets through recent acquisitions and its focus on flexibility, integration and collaboration.

1,200 engineers

The company’s digital business grew its net revenue 29%, excluding its advocacy businesses, which are tied to the election cycle. Of the company’s net revenue, 51% came from digital capabilities. This is reflected in its work with blue-chip brands like Home Depot and Chipotle. Stagwell brands Code and Theory, YML and Targeted Victory manage much of the digital work, and the company employs 1,200 engineers across the globe, with presences in the U.S., India, Argentina and the Philippines.

A digital-first mentality led Stagwell to develop an SaaS offering for its clients coined The Stagwell Marketing Cloud. Its products include a new augmented reality technology for use at live sporting events, and the company is also building out a full technology stack. The cloud is the company’s novel solution to in-housing. By licensing its technology to clients, the holding company can play an active role in supporting in-housing operations and remain relevant as fewer companies seek external services.

Consolidation is king

The holding company’s agency brands include 72andSunny, Assembly, MMI, Anomaly, Doner, Code and Theory, GALE, YML, Crispin Porter Bogusky and more. It’s on an acquisition spree, and this year it acquired U.K agency Goodstuff and the remaining 49% of digital agency Instrument. It now has over 10,000 employees in over 34 countries and counts over 4,000 companies as clients.

Its been consolidating its subsidiaries, recently merging sister agencies Assembly and ForwardPMX, along with MMI and Media Kitchen.

Consolidation creates scale, and according to Penn, it’s behind the recent success. “Right away, I think we’re in much larger pitches and I think we’re seeing much stronger outcomes there,” he said.

The company’s net new business wins totaled $75 million in the fourth quarter with several accounts over $10 million. Its big accounts include Dunkin’, MilkPEP, H&R Block and Pollstar.

“These are great wins, in both the diversity of services and different verticals of business,” Penn told Adweek. New business wins in the third quarter totaled about $65 million.

Scaling up

On a call with analysts this morning, Penn announced that Stagwell’s operations in Russia, supported by 10 employees, would shut down. He worries about international conditions related to the war in Ukraine, he told Adweek. “I do think the world has a way of working things out,” he added. “Let’s hope that happens.”

Amidst the international turmoil, the holding company is focused on achieving global scale. Its acquisition of Goodstuff expanded its presence in the U.K. and the company plans to expand its portfolio.

“We have some good acquisitions in the pipeline and we achieved our 50 affiliate goal,” he added, referencing Stagwell’s global affiliate network.

Penn feels the market views Stagwell as a wholly different enterprise now, especially as it is achieving large-scale success.

“I started this about six years ago from zero. I started it to focus on building out digital-first services. That approach is the differentiating approach. I think they didn’t know what to make of us until the merger closed.” said Penn. “They realized we’re a $2 billion platform with over 10,000 people and diversified across every essential marketing service.”

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Weekly Data

Dec 05, 2024

WHAT THE DATA SAY: 20% might move if neighbors didn’t do holiday decorations

‘TIS THE SEASON TO DECK THE OUTDOORS: Holiday cheer influences…

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

Newsletter

Sign Up

NEW YORK, March 9, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today released a nearly 2-minute video summarizing its financial performance and strategic progress through full-year 2021. The reel is a dynamic complement to Stagwell’s earnings materials for the three and twelve months ended December 31, 2021, released on Tuesday, March 8, 2022. To view the video, click here. For the earnings release, click here.

“Why shouldn’t we give investor content the marketing treatment? Enter “Earnings: The Movie” – perhaps the easiest way to digest Stagwell’s breakout financial results for 2021 and the goals of the company as it charts growth in 2022,” said Mark Penn, Chairman and CEO, Stagwell. “If you have found earnings releases in general to be boring, we hope this video is a breath of a fresh air and a reminder that an investment in Stagwell is an investment in the future of marketing.”

Production on the video was completed in-network by Stagwell production unit Cahoots Studio, part of the Doner Partners Network. In addition to the video, management has prepared a one-page overview of the company’s Q4 and FY 2021 performance which can be downloaded here.

For questions about Stagwell’s financial performance, please reach out to ir@stagwellglobal.com. A recording of Stagwell’s earnings webcast on Tuesday, March 8, 2022, and other investor materials can be accessed on our site, www.stagwellglobal.com/investors.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

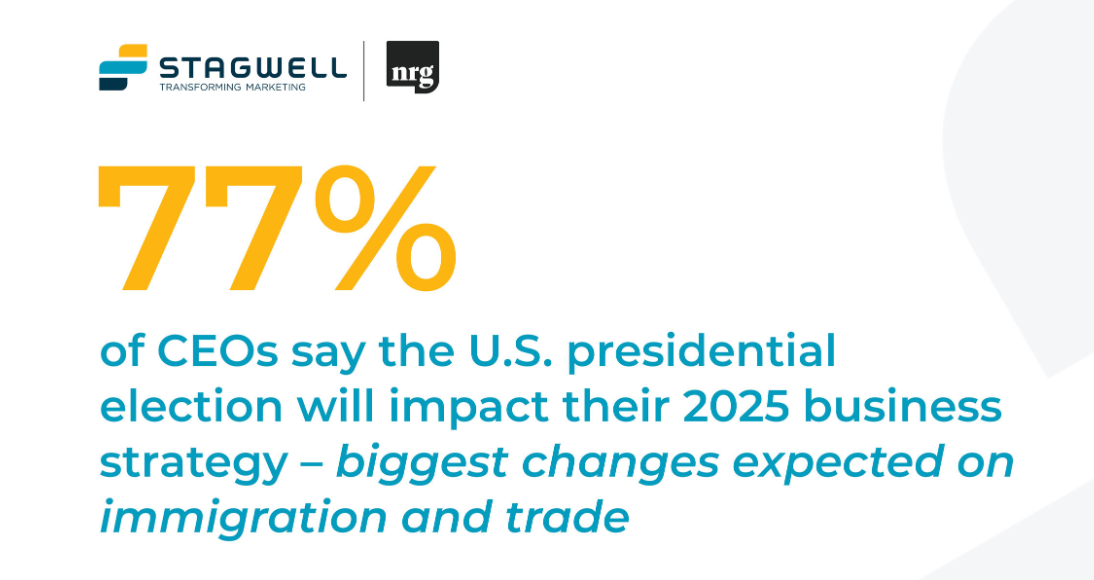

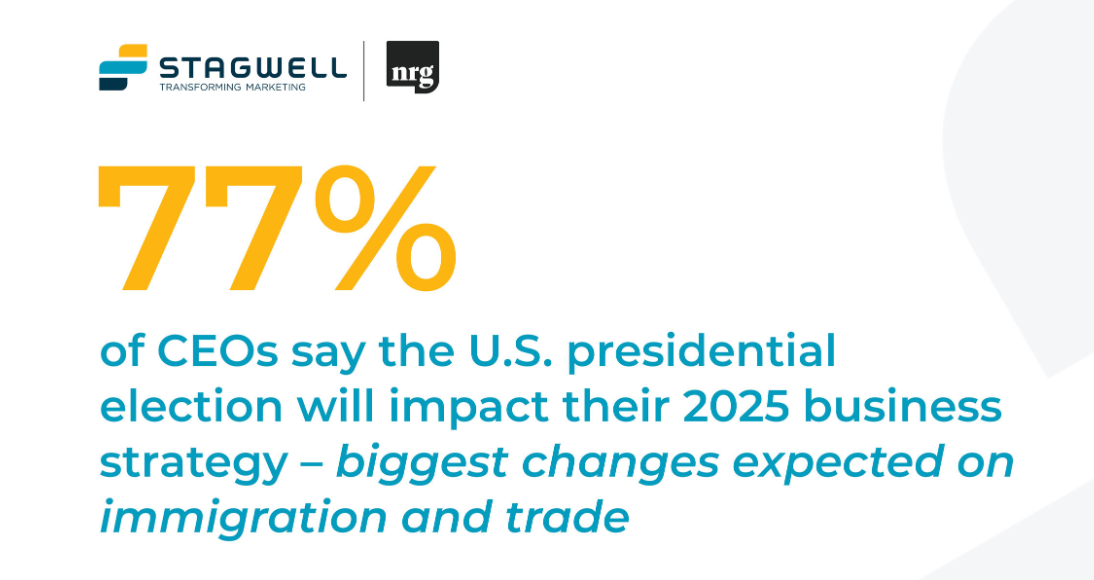

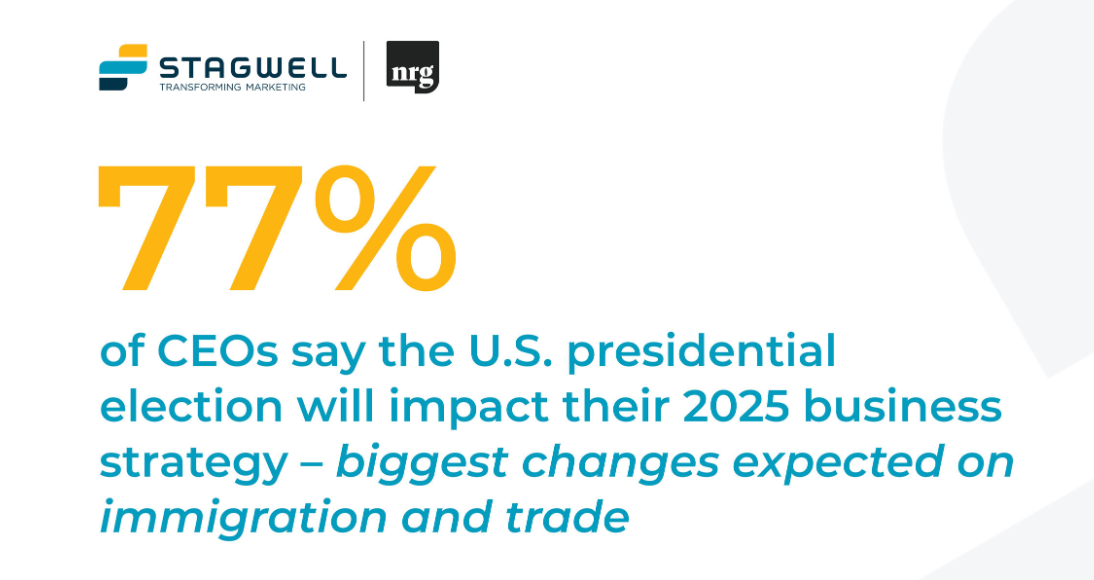

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

CONTACT

ir@stagwellglobal.com

SIGN UP FOR OUR IR BLASTS

Record first full-year financial results as Stagwell Inc. were fueled by fast growing digital transformation and digital marketing services, expansion of global media and large client wins.

Earnings: The Movie

Earnings

Materials

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Nov 25, 2024

Stagwell (STGW) Announces December Investor Conference Schedule

In the News, Investments & Financials, Press Releases

Nov 07, 2024

STAGWELL INC. (NASDAQ: STGW) REPORTS RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

Newsletter

Sign Up

Originally released on

FEATURING

Record first full-year financial results at Stagwell Inc. were fueled by fast growing digital transformation and digital marketing services, expansion of global media and large client wins

-

GAAP Revenue growth of 95.5% in 4Q and 65.5% for the Full-Year

-

Pro Forma Organic Net Revenue growth of 11.3% in 4Q and 14.5% for the Full-Year

-

Ex-Advocacy Pro Forma Organic Net Revenue growth of 21.2% in 4Q and 18.0% for the Full-Year

-

Net Income attributable to Stagwell of $0.8M in 4Q and Net Income of $21.0M for the Full-Year

-

Pro Forma Adjusted EBITDA of $103.6M in 4Q and $378.0M for the Full-Year

-

Issues 2022 Pro Forma Net Revenue growth guidance of 18%-22% and 13%-17% ex-Advocacy

-

Issues 2022 Adjusted EBITDA guidance of $450M – $480M and Pro Forma Free Cash Flow growth of ~30%

New York, NY, March 8, 2022 (NASDAQ: STGW) – Stagwell Inc. (“Stagwell”) today announced financial results for the three and twelve months ended December 31, 2021.

REPORTED FOURTH QUARTER & YTD HIGHLIGHTS:

- Fourth quarter revenue of $611.9 million, an increase of 95.5% versus the prior year period; full-year revenue of $1,469.4 million, an increase of 65.5% versus a year ago.

- Fourth quarter net revenue of $519.7 million, an increase of 160.9% versus the prior period; full-year net revenue of $1,268.9 million, an increase of 100.4% versus a year ago.

- Fourth quarter net income attributable to Stagwell Inc. common shareholders of $0.8 million versus net income of $22.2 million in the prior year period; full-year net income of $21.0 million versus $56.4 million in the prior year period.

- Fourth quarter adjusted EBITDA of $103.6 million, an increase of 61.3% versus the prior year period; full-year adjusted EBITDA of $253.7 million an increase of 2% versus a year ago.

PRO FORMA FOURTH QUARTER & YTD STAGWELL INC. HIGHLIGHTS:

- Fourth quarter Pro Forma revenue of $611.9 million, a decline of 4.6% versus the prior year period and an increase of 18.0% ex-Advocacy; full-year Pro Forma revenue of $2,224.3 million, an increase of 6.6% and an increase of 18.2% ex-Advocacy versus the prior year period.

- Fourth quarter Pro Forma net revenue of $519.7 million, an increase of 10.4% and 20.2% ex-Advocacy vs. a year ago; full-year Pro Forma net revenue of $1,926.8 million, an increase of 16.4% and 20.0% ex-Advocacy versus the prior year period.

- Fourth quarter Pro Forma organic net revenue increased 11.3% and 21.2% ex-Advocacy versus a year ago; full-year Pro Forma organic net revenue increased 14.5% and 18.0% ex-Advocacy versus a year ago.

- Fourth quarter Pro Forma adjusted EBITDA was $103.6 million, a decrease of 5.1% versus the prior year period and an increase of 31.2% ex-Advocacy; full-year Pro Forma adjusted EBITDA was $378.0 million, an increase of 19.6% versus the prior year period and an increase of 41.4% ex-Advocacy.

- Fourth quarter Pro Forma adjusted EBITDA margin was 19.9% of net revenue and full-year adjusted EBITDA margin was 19.6% of net revenue.

- Net New Business wins totaled $75 million in the fourth quarter.

“2021 was a breakthrough year for Stagwell. Our full-year results and 2022 outlook are a clear affirmation of the combination and Stagwell’s unique position as the challenger that will transform marketing,” said Mark Penn, Chairman and Chief Executive Officer. “We delivered pro forma organic net revenue growth of 14.5% for the year and an even more impressive 18% organic growth when excluding our Advocacy businesses, which lapped the 2020 election cycle.”

“Our record year was driven by tailwinds across our high concentration of leading digital capabilities, including digital transformation, influencer and global performance marketing; as well as a rapid acceleration in large contract wins,” Penn continued. “Our robust 2022 outlook reflects our expectation for continued digital strength; continued acceleration in scaled, integrated contract wins; and significant growth in the second-half in our Advocacy businesses driven by an anticipated record year of spend during the 2022 U.S. mid-term elections.”

Frank Lanuto, Chief Financial Officer, commented: “The Company reported strong fourth quarter net revenue of $520 million, representing pro forma net revenue growth of 10.4% year-over-year with 11.3% organic growth. Strong operating performance led to pro forma adjusted EBITDA margins of 19.9% for the quarter. Effective cash flow management permitted our continued acquisitions of both minority interests in our fastest growing subsidiaries as well as the acquisition of Goodstuff in the UK while lowering our net leverage ratio from the prior quarter.”

Financial Outlook

2022 financial guidance is as follows:

- Pro Forma Net Revenue growth of 18% – 22%

- Pro Forma Net Revenue growth ex-Advocacy of 13% – 17%

- Adjusted EBITDA of $450 million – $480 million

- Pro Forma Free Cash Flow growth of approximately 30%

- Guidance assumes no impact from foreign exchange or acquisitions or dispositions.

|

* The Company has excluded a quantitative reconciliation with respect to the Company’s 2022 guidance under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K. See “Non-GAAP Financial Measures” below for additional information. |

Webcast

Management will host a video webcast on Tuesday, March 8, 2022, at 8:30 a.m. (ET) to discuss results for Stagwell Inc. for the three and twelve months ended December 31, 2021. The video webcast will be accessible at https://stagwellq4andfullyear2021earnings.open-exchange.net. An investor presentation has been posted on our website at www.stagwellglobal.com/investors and may be referred to during the conference call.

A recording of the conference call will be accessible one hour after the call and available for ninety days at www.stagwellglobal.com.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 34+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Basis of Presentation

The acquisition of MDC Partners (MDC) by Stagwell Marketing Group (SMG) was completed on August 2, 2021. The results of MDC are included within the Statement of Operations for the period beginning on the date of the acquisition through the end of the respective period presented and the results of SMG are included for the entire period presented.

Non-GAAP Financial Measures

In addition to its reported results, Stagwell Inc has included in this earnings release certain financial results that the Securities and Exchange Commission (SEC) defines as “non-GAAP Financial Measures.” Management believes that such non-GAAP financial measures, when read in conjunction with the Company’s reported results, can provide useful supplemental information for investors analyzing period to period comparisons of the Company’s results. Such non-GAAP financial measures include the following:

Pro Forma Results: The Pro Forma amounts presented for each period were prepared by combining the historical standalone statements of operations for each of legacy MDC and SMG. The unaudited pro forma results are provided for illustrative purposes only and do not purport to represent what the actual consolidated results of operations or consolidated financial condition would have been had the combination actually occurred on the date indicated, nor do they purport to project the future consolidated results of operations or consolidated financial condition for any future period or as of any future date. The Company has excluded a quantitative reconciliation of adjusted Pro Forma EBITDA to net income under the “unreasonable efforts” exception in Item 10(e)(1)(i)(B) of Regulation S-K.

(1) Organic Revenue: “Organic revenue growth” and “organic revenue decline” refer to the positive or negative results, respectively, of subtracting both the foreign exchange and acquisition (disposition) components from total revenue growth. The acquisition (disposition) component is calculated by aggregating prior period revenue for any acquired businesses, less the prior period revenue of any businesses that were disposed of during the current period. The organic revenue growth (decline) component reflects the constant currency impact of (a) the change in revenue of the partner firms that the Company has held throughout each of the comparable periods presented, and (b) “non-GAAP acquisitions (dispositions), net”. Non-GAAP acquisitions (dispositions), net consists of (i) for acquisitions during the current year, the revenue effect from such acquisition as if the acquisition had been owned during the equivalent period in the prior year and (ii) for acquisitions during the previous year, the revenue effect from such acquisitions as if they had been owned during that entire year (or same period as the current reportable period), taking into account their respective pre-acquisition revenues for the applicable periods, and (iii) for dispositions, the revenue effect from such disposition as if they had been disposed of during the equivalent period in the prior year.

(2) Net New Business: Estimate of annualized revenue for new wins less annualized revenue for losses incurred in the period.

(3) Adjusted EBITDA: defined as Net income excluding non-operating income or expense to achieve operating income, plus depreciation and amortization, stock-based compensation, deferred acquisition consideration adjustments, and other items. Other items include restructuring costs, acquisition-related expenses, and non-recurring items.

(4) Free Cash Flow: defined as Adjusted EBITDA less capital expenditures, change in net working capital, cash taxes, interest, and distributions to minority interests, but excludes contingent M&A payments.

(5) Financial Guidance: The Company provides guidance on a non-GAAP basis as it cannot predict certain elements which are included in reported GAAP results.

Included in this earnings release are tables reconciling reported Stagwell Inc. results to arrive at certain of these non-GAAP financial measures.

This press release contains forward-looking statements. Statements in this press release that are not historical facts, including without limitation the information under the heading “Financial Outlook” and statements about the Company’s beliefs and expectations, earnings (loss) guidance, recent business and economic trends, potential acquisitions, and estimates of amounts for redeemable noncontrolling interests and deferred acquisition consideration, constitute forward-looking statements. Words such as “estimates”, “expects”, “contemplates”, “will”, “anticipates”, “projects”, “plans”, “intends”, “believes”, “forecasts”, “may”, “should”, and variations of such words or similar expressions are intended to identify forward-looking statements. These statements are based on current plans, estimates and projections, and are subject to change based on a number of factors, including those outlined in this section. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update publicly any of them in light of new information or future events, if any.

Some of the factors that could materially and adversely affect our business, financial condition, results of operations and cash flows include, but are not limited to, the following:

- risks associated with international, national and regional unfavorable economic conditions that could affect the Company or its clients, including as a result of the novel coronavirus pandemic (“COVID-19”);

- the effects of the outbreak of COVID-19, including the measures to reduce its spread, and the impact on the economy and demand for our services, which may precipitate or exacerbate other risks and uncertainties;

- an inability to realize expected benefits of the combination of the Company’s business with the business of MDC (the “Business Combination” and, together with the related transactions, the “Transactions”);

- adverse tax consequences in connection with the Transactions for the Company, its operations and its shareholders, that may differ from the expectations of the Company, including that future changes in tax law, potential increases to corporate tax rates in the United States and disagreements with the tax authorities on the Company’s determination of value and computations of its attributes may result in increased tax costs;

- the occurrence of material Canadian federal income tax (including material “emigration tax”) as a result of the Transactions;

- direct or indirect costs associated with the Transactions, which could be greater than expected;

- risks associated with severe effects of international, national and regional economic conditions;

- the Company’s ability to attract new clients and retain existing clients;

- reduction in client spending and changes in client advertising, marketing and corporate communications requirements;

- financial failure of the Company’s clients;

- the Company’s ability to retain and attract key employees;

- the Company’s ability to achieve the full amount of its stated cost saving initiatives;

- the Company’s implementation of strategic initiatives;

- the Company’s ability to remain in compliance with its debt agreements and the Company’s ability to finance its contingent payment obligations when due and payable, including but not limited to those relating to redeemable noncontrolling interests and deferred acquisition consideration;

- the successful completion and integration of acquisitions which complement and expand the Company’s business capabilities; and

- foreign currency fluctuations.

Investors should carefully consider these risk factors, other risk factors described herein, and the additional risk factors outlined in more detail in Exhibit 99.2 to our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “SEC”) on August 10, 2021, and accessible on the SEC’s website at www.sec.gov., under the caption “Risk Factors,” and in the Company’s other SEC filings.

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

NEW YORK, March 3, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced Chairman and CEO Mark Penn will attend the upcoming Deutsche Bank 30th Annual Media, Internet, & Telecom Conference in Palm Beach, Florida on March 15, 2022. Management will also host several 1X1 sessions with investors at the conference. To coordinate a meeting, please contact Michaela Pewarski, VP, Investor Relations at ir@stagwellglobal.com.

Stagwell’s Q4 and full-year 2021 earnings webcast will take place the week prior to the conference on Tuesday, March 8 at 8:30 AM ET. Visit this link to register and access the webcast.

To learn more about Stagwell, visit https://www.stagwellglobal.com/investors/

About Stagwell

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 20+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Contact:

Michaela Pewarski

ir@stagwellglobal.com

646-429-1812

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

In the News, Press Releases

Dec 02, 2024

Ray Day Assumes Role of Executive Chairman at Allison Worldwide; Co-Founders Scott Allison and Andy Hardie-Brown Stepping Down

Newsletter

Sign Up

NEW YORK, Feb. 8, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW) announced today the Company will report financial results for the three and twelve months ended December 31, 2021 on Tuesday, March 8, 2022, before the market open.

Stagwell will host a video webcast to review those results the same day at 8:30 AM (ET). To register and view the webcast, visit this link.

A replay of the webcast will be available following the event at Stagwell’s website, https://www.stagwellglobal.com/investors/

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Nov 25, 2024

Stagwell (STGW) Announces December Investor Conference Schedule

In the News, Investments & Financials, Press Releases

Nov 07, 2024

STAGWELL INC. (NASDAQ: STGW) REPORTS RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

In the News, Investments & Financials, Press Releases

Oct 10, 2024

Stagwell (STGW) Schedules Webcast to Discuss Financial Results for the Three Months Ended September 30, 2024

Newsletter

Sign Up

New York, NY, January 14, 2022 (NASDAQ: STGW) – Stagwell announced today that Mark Penn, Chairman and CEO, will attend the upcoming Sidoti Winter SmallCap Virtual Conference on Wednesday, January 19 and Thursday, January 20, 2022. Penn will give a management presentation on Thursday at 10:45 a.m. ET. To register and access the presentation, please visit this link.

Penn will also be available for 1:1 investor meetings. For more information, please reach out to ir@stagwellglobal.com.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 20+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…

Newsletter

Sign Up

Originally released on

CONTACT

Beth Sidhu

FEATURING

NEW YORK, Jan. 12, 2022 /PRNewswire/ — Stagwell (NASDAQ: STGW), the challenger network built to transform marketing, today announced an investment into early-stage venture capital firm Hannah Grey, a first-check fund investing in customer-centric founders redefining everyday experiences. Stagwell’s investment in Hannah Grey VC is part of an overall strategy to accelerate growth across the new disciplines of digital marketing services, including digital media, digital transformation, and data & software products.

Hannah Grey VC was co-founded by Jessica Peltz Zatulove—who for previously served as Senior Managing Partner at the corporate VC arm of Stagwell’s predecessor company, and Kate Beardsley, former Managing Partner of Upslope Ventures (FKA Galvanize Ventures) and Founding Member of Lerer Hippeau. During her prior tenure in the Stagwell network, Peltz sourced and led investments in breakout companies such as A.I. intelligence company Netomi, Amazon insights platform Gradient.io, and found content platform Catch & Release, among others.

“As illustrated by the products we brought to life at CES this year, Stagwell is focused on the frontiers transforming the ways consumers engage with and experience products and services,” said Mark Penn. “Jessica has long demonstrated strong insight into the consumer’s evolving relationship with emerging technology and the impact that has on the brands. Their team’s nuanced expertise of empowering the Modern CMO to embrace new trends, combined with their extensive access to founders building at the cutting edge is a competitive advantage I’m excited to bring to Stagwell.”

“At Hannah Grey, our investment strategy puts an emphasis on monitoring the behavior changes and cultural shifts that are accelerating new ways consumers live, work and play. This creates a strong alignment with Stagwell’s mission to transform connected experiences for today’s consumers,” added Peltz. “I’m thrilled to have the continued support of the Stagwell leadership team.

In addition to external investments, Stagwell recently unveiled the Stagwell Marketing Cloud, a suite of products supporting business transformation for in-house teams, including ARound, built to scale augmented-reality experiences for live experiences and retail.

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 20+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Events, In the News, Investments & Financials, Press Releases

Nov 25, 2024

Stagwell (STGW) Announces December Investor Conference Schedule

In the News, Investments & Financials, Press Releases

Nov 07, 2024

STAGWELL INC. (NASDAQ: STGW) REPORTS RESULTS FOR THE THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2024

In the News, Investments & Financials, Press Releases

Oct 10, 2024

Stagwell (STGW) Schedules Webcast to Discuss Financial Results for the Three Months Ended September 30, 2024

Newsletter

Sign Up

Originally released on

FEATURING

Fully aligns leadership team with Stagwell’s digital growth strategy and supports future of agency as part of the network

New York, New York. January 6, 2022 – Stagwell Inc. (NASDAQ: STGW) announced today it has acquired the remaining 49% of Instrument, a leading digital brand and experience innovation company. Founded in Portland, Oregon, Instrument is one of Stagwell’s fastest growing agencies and employs over 400 people working on clients including Nike, Google, Salesforce and Epic Games. Stagwell’s predecessor company, MDC Partners, had acquired 51% of Instrument in 2018.

“Instrument is all in with Stagwell,” said Stagwell Chairman and CEO Mark Penn. “Instrument is a first-rate digital company, having grown over 30% annually in each of the past two years. The entire leadership team has done an excellent job of growing their business while developing a culture of innovation, inclusion and outstanding client service. We are pleased to welcome Instrument into the network fully and to have Justin, JD and their team onboard for the next phase of the company’s growth and development.”

“We believe in Instrument’s future with Stagwell and are pleased to take the final step into the network,” said Instrument CEO Justin Lewis. “We are looking forward to being a full part of Stagwell and the Constellation and to the growth and development opportunities this investment will provide for our team.”

Stagwell’s additional investment in Instrument fully aligns Stagwell with one of its fastest-growing businesses, provides for easier-to-scale digital operations and creates greater certainty for investors through full-ownership. The deal includes a fixed payment amount spread across a three-year term, split between cash and stock in STGW. This mutually beneficial structure provides Instrument’s management with appropriate incentives for their efforts and creates significant shareholder value.

The completion of the current transaction brings to a close the uncertainty associated with uncapped earn-outs for all prior investments and greatly improves management of leverage and investment returns. With this deal, all previous uncapped earn-out deals have now been restructured. Stronger than expected free cash flow from Stagwell’s consolidated operations combined with the cash/equity payment structure enabled Stagwell to move forward with the completion of this acquisition at this time while further deleveraging the company’s balance sheet.

“We have moved to expand our portfolio of high growth digital assets, increase free cash flows, effectively manage leverage and end uncapped earn-out structures,” said Stagwell Chief Financial Officer Frank Lanuto.

##

About Stagwell Inc.

Stagwell is the challenger network built to transform marketing. We deliver scaled creative performance for the world’s most ambitious brands, connecting culture-moving creativity with leading-edge technology to harmonize the art and science of marketing. Led by entrepreneurs, our 10,000+ specialists in 20+ countries are unified under a single purpose: to drive effectiveness and improve business results for their clients. Join us at www.stagwellglobal.com.

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO

In the News, Press Releases

Dec 02, 2024

Ray Day Assumes Role of Executive Chairman at Allison Worldwide; Co-Founders Scott Allison and Andy Hardie-Brown Stepping Down

Newsletter

Sign Up

Originally released on

by Gideon Spanier

CONTACT

Beth Sidhu

FEATURING

The co-founders of Goodstuff Communications have sold their independent media agency to Stagwell, the US-listed “challenger” holding company.

Andrew Stephens and Ben Hayes, who set up Goodstuff in London in 2004, told Campaign the deal would enable them to add digital, data and technology capabilities and grow the agency’s business in the UK, as part of their strategic ambition to take their company from “Good to Great”.

Goodstuff – the UK’s second-biggest independent media agency and the 14th largest overall, with an estimated £208m in annual billings in 2020, according to Campaign’s School Reports – will retain its brand.

Stephens and Hayes have also committed to the company for five years as part of their earn-out.

The deal was agreed just days before Christmas. Financial terms were not disclosed but Goodstuff is likely to have sold for more than £30m on the basis that it reported profit before exceptional items, known as Ebitda, of £3.4m in the year before the pandemic, and typically an agency will sell for about 10 times annual profits.

Companies House filings show Stephens and Hayes controlled all the shares of Goodstuff Holdings but it is thought their combined stake ended up being closer to 75%, because eight other senior executives had share options that vest following the sale.

The eight partners are Simeon Adams, Bobby Din, Sam Drake, Paul Gayfer, Laura Moorcraft, Megan Stuart, Genevieve Tompkins and Simon Wilden.

Goodstuff employs about 130 people and has created a deal bonus pot to reward other staff with proceeds from the sale.

The agency will become part of Stagwell Media Network, the media arm, which has 3,000 staff and claims to manage close to $5bn (£3.7bn) in annual spend globally.

Mark Penn, a former Microsoft and WPP executive, founded Stagwell in 2015. It has since acquired dozens of agencies, including MDC Partners, the owner of creative shops 72andSunny and Anomaly and media agency Assembly. Stagwell has about 10,000 employees around the world.

Stephens and Hayes said: “Goodstuff’s unswerving mission is to be the world’s most inventive media agency, and to help accelerate our next phase, we wanted to join a network that could bring world-class capabilities in data, technology, and digital.

“In Stagwell, we’ve not only found these services, but also a partner that perfectly aligns with our culture of entrepreneurialism, invention, and progress. We’ve been hugely impressed by Stagwell’s challenger status and ambitions, their senior leadership team, and the breadth of world-class modern marketing brands in the group.”

Penn, who is chairman and chief executive of Stagwell, said: “We welcome Goodstuff as a critical part of our strategy to create a truly global and competitive media operation.

“When we created Stagwell Media Network [in September 2021], we set out to build a collaborative and coherent network of global media agencies that are on the leading edge of media, data, and technology. The addition of Goodstuff, with their unrivalled track record of innovation, continues to deliver on our vision of transforming marketing.”

It is understood that Goodstuff and Assembly worked together on pitching for at least one – unnamed – client last year, which encouraged both sides to consider an M&A deal.

James Townsend, global chief executive of Stagwell Media Network, said: “What attracted us to the agency were their world-class leadership and unwavering focus on people, culture, and the work.

“After a series of successful collaborations with Assembly in the UK, we see the potential for our network to build something truly differentiated, progressive, and exciting in the marketplace.”

Sale reflects Goodstuff’s need for digital, data and tech capabilities

Stephens, who is 50, and Hayes, 54, met in their twenties at Saatchi & Saatchi, before moving to Manning Gottlieb OMD, where they incubated Goodstuff – initially as a planning agency, before expanding into buying in 2011.

Omnicom, the parent company of Manning Gottlieb OMD, retained a minority stake until 2017, when Stephens and Hayes took 100% control.

The agency has won a reputation for its creative and collaborative approach, attracting clients such as Cazoo, Ovo, On the Beach and Yorkshire Tea, winning Grands Prix at both the Media Week Awards and Campaign Media Awards in 2019 and 2020, and staging the annual Goodstuff Media Showcase, where media owners are invited to pitch ideas to creative agencies.

The founding partners have prided themselves on Goodstuff’s independent ownership, but there was speculation that they were considering a sale in autumn 2019 and the rumours resurfaced in the same period of 2021.

Their decision to sell now appears to be significant as clients increasingly look for one agency partner that can offer full-funnel, omnichannel planning and buying across both digital and traditional media.

Goodstuff is known for its expertise in communications planning and broadcast TV, whereas Stagwell’s media capabilities are chiefly in digital and performance marketing. Stagwell acquired specialists such as Forward3D and PMX and subsequently merged them with Assembly, a traditional media agency.

Stephens and Hayes explained the rationale for the sale in a company blog post, describing it as “a recognition that whilst we’re one of the UK’s leading media agencies now, the digital, data and technology industry around us is changing at such pace that, if we’re to realise our stated mission [to move from ‘Good to Great’], we must similarly change, and evolve our offering”.

Goodstuff initially talked to several “digital specialists” about the idea of an “informal” partnership, before moving to discussions about a sale, according to the blogpost.

Stephens added they were certain that they did not want to sell to one of the established agency giants or a private equity investor because that would not help Goodstuff to achieve its ambitions.

Headroom for growth in the UK

Goodstuff Communications is Stagwell’s first acquisition since the merger of MDC Partners completed in August 2021 through a reverse takeover. The company is listed on the New York stock market.

Penn has talked about building Stagwell into “a digital-first alternative to traditional agency holding companies”. It is one of several “challenger” groups – including S4 Capital, You & Mr Jones and Dept – to have emerged in recent years.

He told investors at Stagwell’s Q3 results that “making sure that we have on[line] and offline media on a global basis” and winning “global contracts” were among his priorities.

Acquiring Goodstuff allows Stagwell to bring together offline and online media in Europe in the same way that it has already done in the US, Townsend told Campaign, stressing the growing need to combine brand building and performance marketing in a single offer that he called “brand performance”.

Stagwell Media Network will have nearly 500 staff in Europe. Assembly employs about 350 people, plus 130 are joining from Goodstuff.

While Goodstuff is expected to support Stagwell Media Network on work across Europe, Stephens and Hayes said their primary focus remains the UK.

There is headroom for growth as they look to compete with bigger rivals, they said, citing Publicis Groupe’s Zenith, WPP’s Essence and Manning Gottlieb OMD as examples of some of the UK’s top 10 media agencies that they rate.

Goodstuff was advised by corporate advisory firm Clarity, law firm Osborne Clarke and accountants Moore Kingston Smith.

Clarity previously worked on Adam & Eve’s sale to Omnicom’s DDB and M&C Saatchi’s sale of Walker Media to Publicis Groupe. Walker Media had a similar profile to Goodstuff and sold at a multiple of 9.2 times annual profits.

Stephens and Hayes stressed in their blog post that “all the good bits of Goodstuff remain unchanged” following the sale.

The post said: “Andrew, Ben and the partners are committed for the long term… our brand, our values, our culture and our relentless focus on inventive work will not shift an inch but as of today, we also have access to world-class digital and data talent, services and technology to bring omnichannel brilliance to the most progressive client brands.”

As part of the sale process, Goodstuff has exited its minority interests in Love Sugar Science and Sixteen By Nine, two agencies that it supported in a start-up initiative, called Startstuff, in 2019.

Related

Articles

Acquisition, In the News, Press Releases

Dec 17, 2024

Stagwell (STGW) Furthers Global Expansion, Agrees to Acquire UNICEPTA, a Leading Provider of Media Intelligence

In the News, Weekly Data

Dec 05, 2024

WHAT THE DATA SAY: 20% might move if neighbors didn’t do holiday decorations

‘TIS THE SEASON TO DECK THE OUTDOORS: Holiday cheer influences…

In the News, Press Releases, Stagwell Marketing Cloud

Dec 04, 2024

Stagwell Marketing Cloud’s The People Platform Appoints George Brady as CEO