Stagwell is further integrating media into its creative agencies as the new holding company kid on the block looks to sustain growth over legacy industry peers.

On its second quarter 2022 earnings call on Thursday, Stagwell leadership spoke about a growth in integrated client opportunities across the network, specifically in accessing media and digital services through its creative agencies.

As a result, CFO Frank Lanuto disclosed that the holding company – formally created one year ago by the combination of Stagwell Marketing Group Holdings and MDC Partners – has reorganized its reporting segments “to more closely bring together media and creative.”

Stagwell will shift creative agencies Crispin Porter + Bogusky, Forsman & Bodenfors, Observatory and Vitro under the Stagwell Media Network. Observatory CEO Jae Goodman stepped down from his role shortly before the change.

Additionally, the holding company is standing up Stagwell Media Studio capabilities in all of its creative agencies, allowing them to tap into the network’s media capabilities more easily and at scale.

Stagwell’s other creative agencies are split across different networks at the holding company that aim to bring digital closer to creative. 72andSunny, for instance, is part of the Constellation Network, which includes digital agency Instrument and research company The Harris Poll. The Doner Partners Network combines the creative agency with PR and influencer marketing shops such as Veritas and HL Group.

“After years of procurement separating media from creative, the demands of the digital world are bringing them together again and we are responding to these trends,” CEO Mark Penn told investors on the earnings call.

The Stagwell Media Network, which launched one year ago and includes agencies Assembly and ForwardPMX, grew 28% in Q2 to $36 million, thanks in part to a few $10 million-plus contract wins.

Performance media and data, which makes up 19% of Stagwell’s business, grew 17% organically year over year. Digital services grew 37% organically year over year and contributed to 57% of net revenues in the quarter.

Strong performance in the media business is driving growth in pure creative services, which are growing inline with GDP at 3% to 5% annually. Integrated assignments, on the other hand, are growing 10% to 15% year over year, Penn said.

“That is a way to spearhead the growth of creative: integrate it more closely with [media] and consumer online experiences,” he added.

Overall Stagwell grew 16% organically in Q2, bringing in $556 million in net revenue. That’s on top of 29% growth in Q2 2021, bringing its “two-year growth stack” to 45%, Penn said.

As Stagwell leans into integration, its average client size grew 30% year over year, from $4.5 million to $6 million, the result of a “land and expand” strategy that is helping extend its services with existing clients. Johnson & Johnson, for instance, grew its remit with Stagwell from four to 12 brands over the past year. Stagwell’s top 25 clients work on average with five agencies across the network.

“We’re seeing a spillover effect,” Penn said. “People are also pitching more jointly across services, which, two or three years ago, they didn’t do at all.”

Unlike its legacy peers in the category which increased their projections, Stagwell reaffirmed its outlook for the quarter, projecting 18% to 22% organic growth for the year.

No recession here

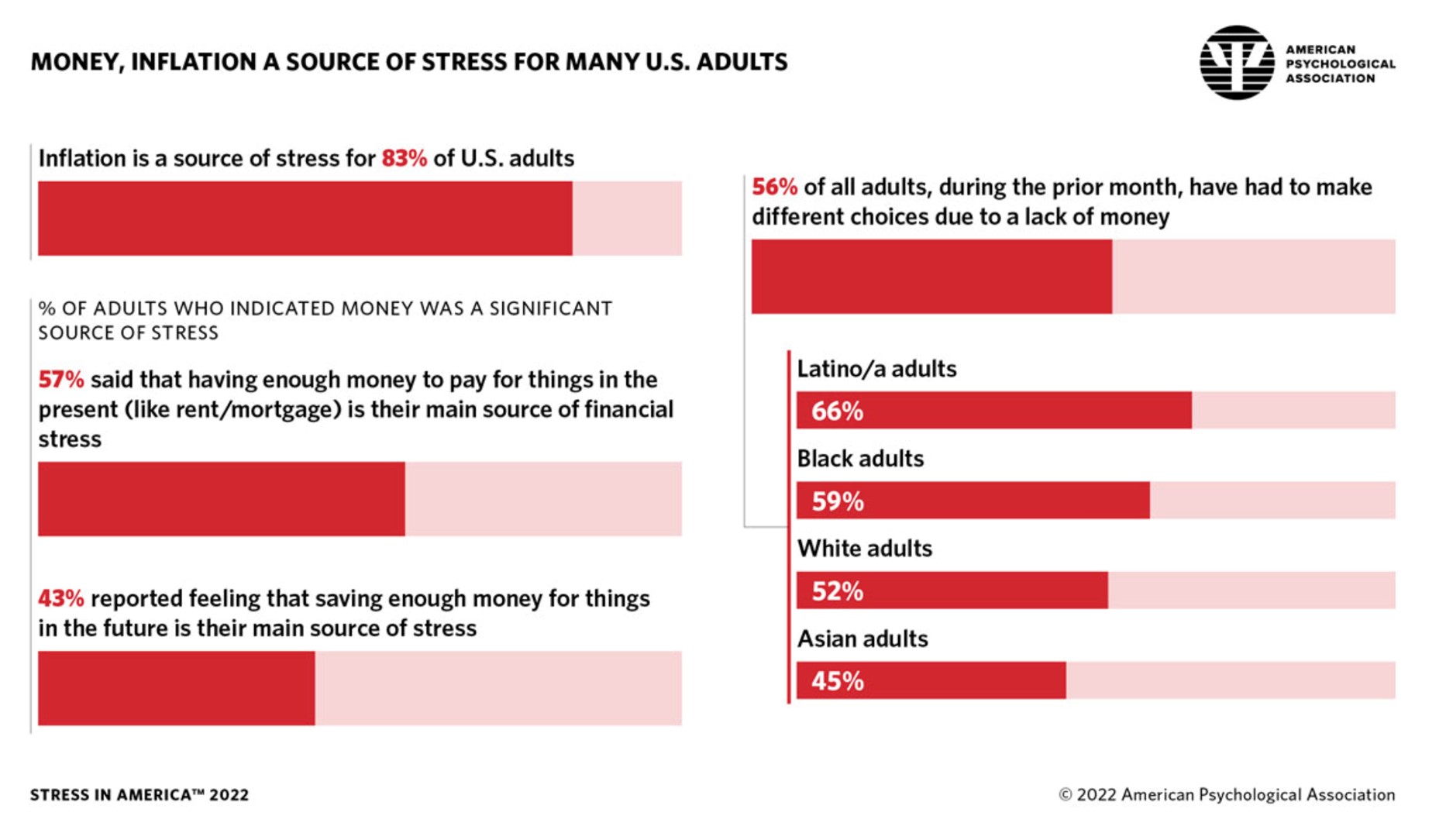

Amid concerns about inflation and an impending recession, and a slowdown in the ad businesses of the largest tech platforms, Penn said Stagwell is seeing strong appetite from clients and “a flood of new business pitches.”

The holding company is also benefiting from the travel industry rebound this summer. Business with travel brands nearly doubled in Q2, contributing to growth in the media network.

“We’re seeing a very strong travel and entertainment summer rebound and what looks like it’s going to be a market competitive holiday season,” Penn said. “If and when I see something different, I’ll report it. It’s just not what we’re seeing in terms of how clients are acting.”

Penn pointed to more competition in the media space, from players such as TikTok and Netflix, as a contributor to Big Tech’s slowing ad businesses.

“People have more than two choices now in their placements,” he said. “The market will be increasingly spread out and harder to read.”

But if the economy does take a turn for the worse, Penn said Stagwell’s focus on digital and performance media will insulate it from client cutbacks.

“It’s less likely that companies are going to cut revenue producing media,” he said.

By Alison Weissbrot. Published August 04,2022