Weekly Data

WHAT THE DATA SAY: 57% say the person who makes most should pay for dates

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

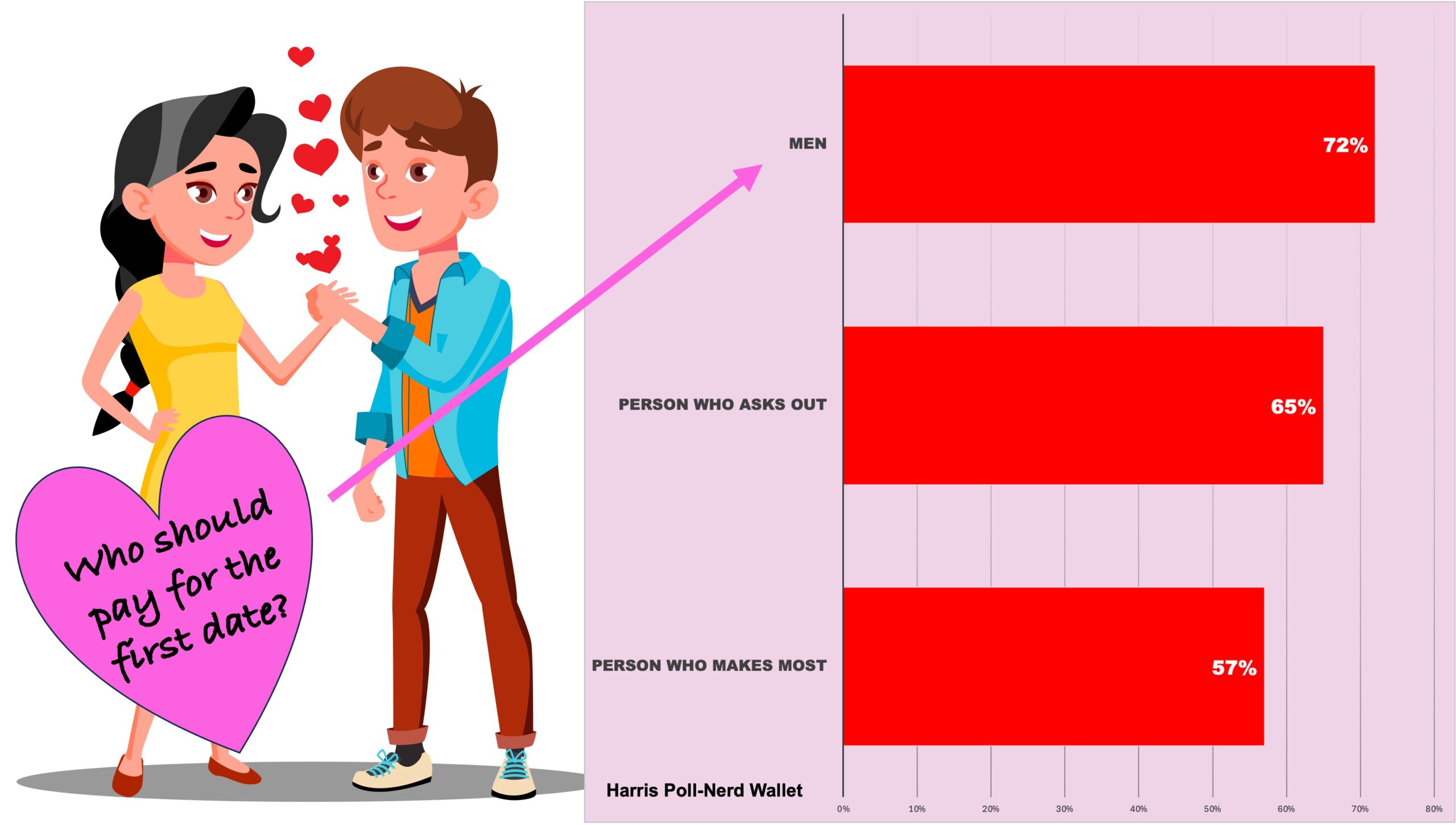

NOT A CHEAP DATE

60% of Americans see pressure on single people to have a date for Valentine’s Day, and those celebrating will spend an average of $188, according to our Harris Poll survey with NerdWallet.

- Gen Z plans to spend the most on the holiday at an average of $274, followed by Millennials at $197, Gen X at $144 and Boomers at $96 on average.

- Men (78%) are more likely to say the man should pay on the first date than women (68%).

- 65% of Americans believe that, if someone asked them out, they would expect that person to pay for the date.

- 57% of Americans agree that the person who makes more money should pay for dates more often than the person who makes less.

- 68% agree that couples should talk about their finances within six months of dating.

ONLINE TO IRL

While younger professionals have a reputation for supporting remote working, our new Harris Poll survey with Freeman shows that Gen Z wants to get back to the office.

- 91% of Gen Z workers want a balance between virtual and in-person opportunities.

- 89% agree that relationships built during in-person events are critical to building professional confidence.

- 86% say that attending in-person events is critical to career development.

- Other reasons for working in person include wanting to feel more comfortable expressing themselves and being with others in person (82%) and being able to interact with people more in the real world (79%).

REALITY OF RETIRMENT

American investors are concerned about being able to retire where they currently live, based on our Harris Poll survey with Nationwide.

- A third (32%) of investors don’t believe it makes financial sense to retire where they currently live, especially those in the Northeast (41%) and West (37%).

- 16% will be forced to relocate to a more affordable region due to the high cost of living in their area.

- 41% of non-retired investors expect to retire at 66 or later, with Northeasterners (47%) slightly more likely to share this view.

- Inflation concerns are highest in the Northeast and Midwest (36% each), followed by the South (34%) and West (29%).

ICYMI:

In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

Related

Articles

Weekly Data

Jan 29, 2026

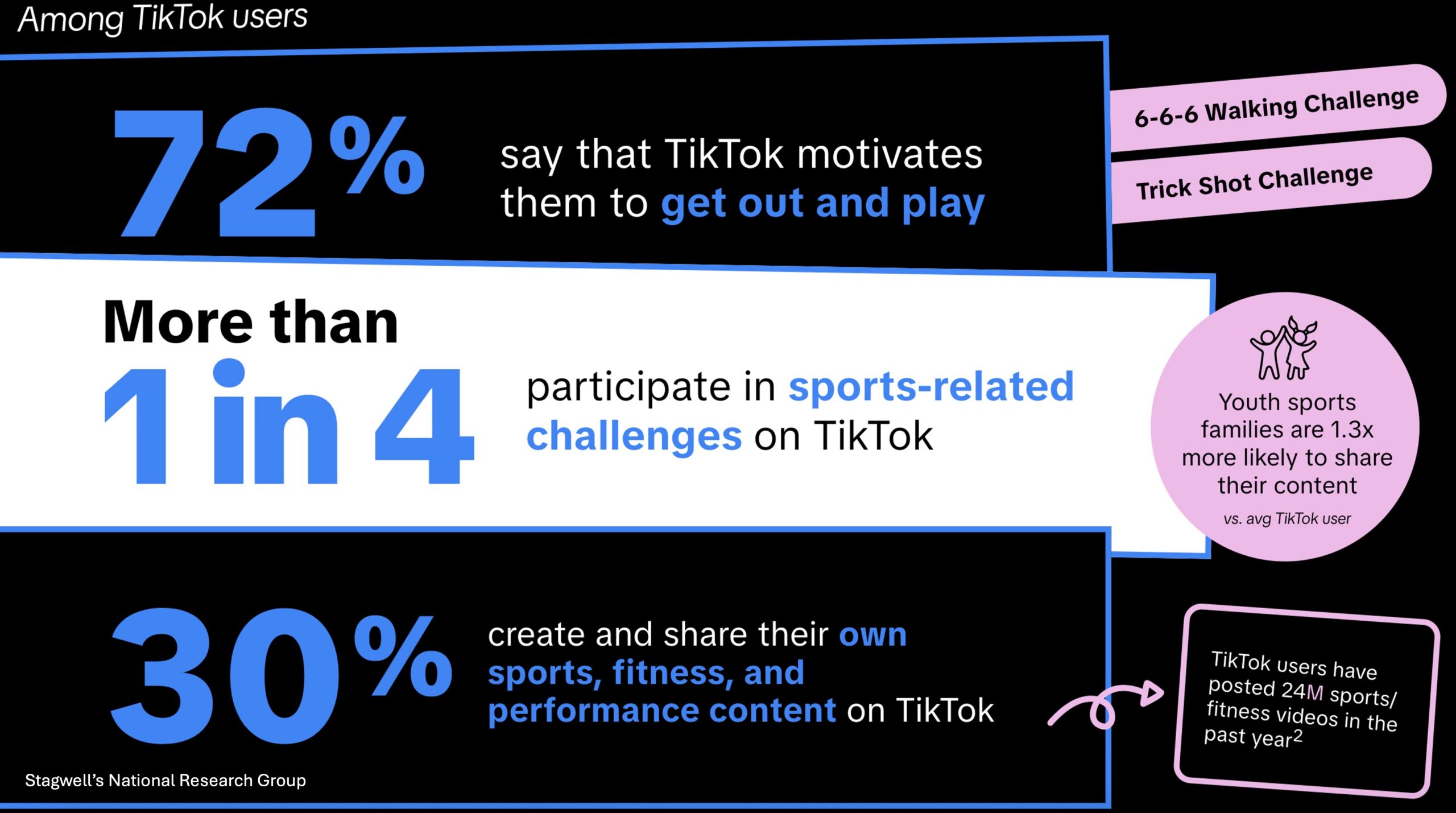

WHAT THE DATA SAY: 62% enjoy watching sports on social media more than on TV

TikTok and social media allow sports fans to engage in…

Artificial Intelligence, In the News, Press Releases, Talent & Awards

Jan 29, 2026

Doner and Colle McVoy Join Forces as DonerColle Partners, Establishing a Center of Creative Gravity in the American Midwest

In the News

Jan 22, 2026

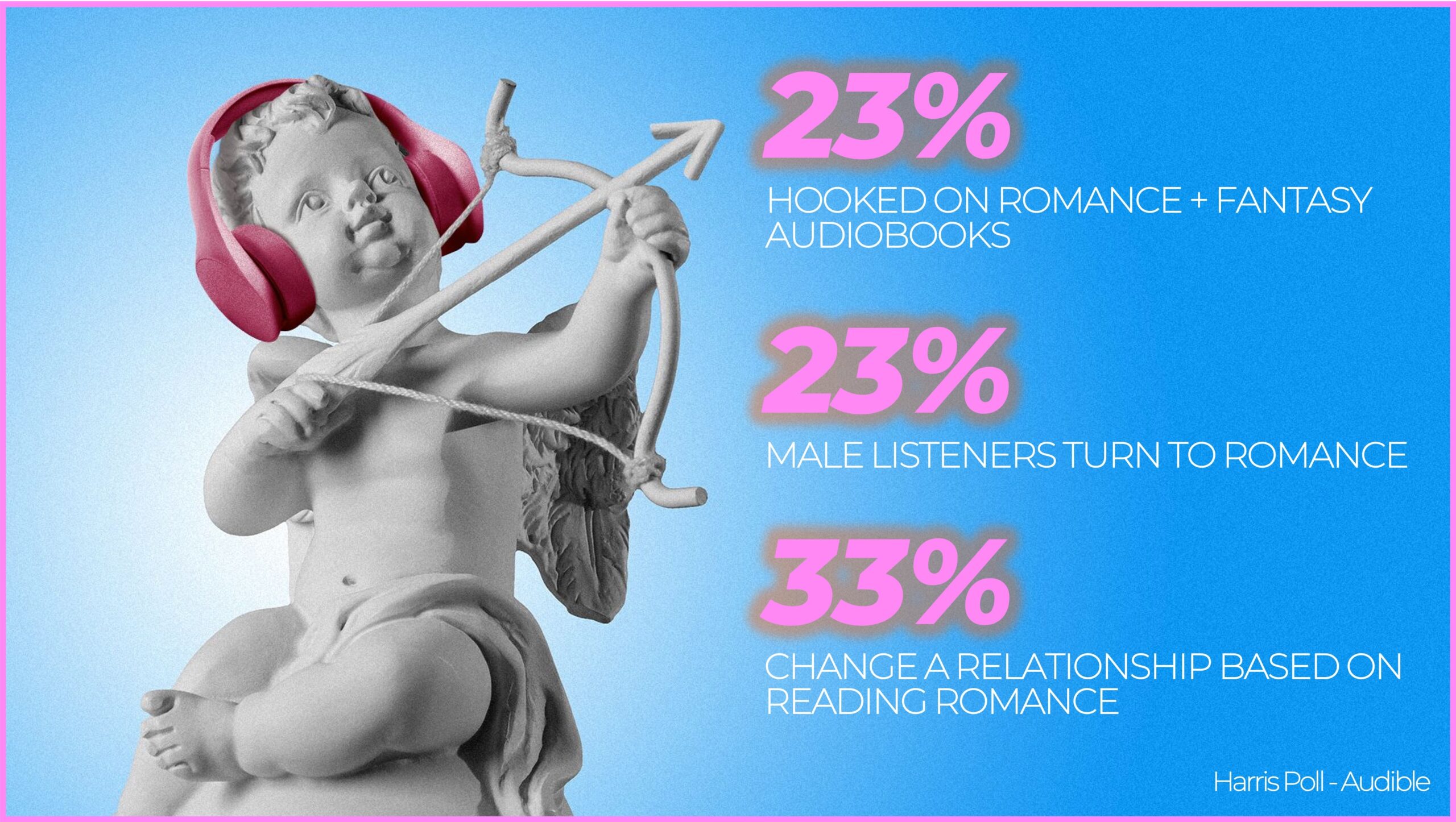

WHAT THE DATA SAY: 23% of audiobook fans hooked on ‘romantasy’

Romance fantasy and related niche genres are attracting new and…