Weekly Data

WHAT THE DATA SAY: This year's Black Friday will become Cyber Friday – with $14 billion in e-sales

By: Ray Day

CONTACT:

We wanted to share our latest consumer and business insights, based on research from Stagwell. Among the highlights of our weekly consumer sentiment tracking:

PARENTS EMBRACE SECOND-HAND BACK-TO-SCHOOL SHOPPING

A majority of parents bought used clothes last year, and it’s part of their back-to-school shopping this year, according to our Harris Poll research in AdAge.

- 40% of parents find styles they like while thrifting.

- 80% of parents say wearing vintage clothing is trendy.

- 7 in 10 parents of school-age children (and 67% of those who aren’t) say more brands should integrate secondhand items into their collections.

- Other money-saving approaches mentioned by back-to-school shoppers included shopping sales (52%), using coupons (32%) and seeking out free options for school supplies (22%).

- Read more: How to Master Thrifty Back-to-School Shopping

HOLIDAY SHOPPERS START EVEN EARLIER

No matter which holiday they celebrate around the world this year – from Ramadan and Christmas to Diwali – consumers are shopping earlier than ever, according to Assembly’s 2024 Holiday Preview. Among the insights:

- In the U.S., modest 4.8% growth in holiday spending is predicted – with an emphasis on everyday items. E-commerce sales will grow 9.5%, and brick and mortar sales will increase 3.7%.

- Physical stores will be important again – serving as showrooms for product demonstrations and dialogue with in-store experts.

- Black Friday will become Cyber Friday – with $14 billion in e-commerce sales that day alone.

- One-third of holiday shopping will begin in October.

- Consumers can expect deep discounts well before Halloween since there are only 27 days between Thanksgiving and Christmas.

- Specialized stores are seeing the strongest growth as the 2024 holiday season begins – with 4.3% year-over-year growth last quarter, followed by clothing (+3.8%) and electronics (+2.2%). Decliners are home and furniture (-4.4%), and building materials (-2.3%).

- In other parts of the world, UK consumers are the most optimistic entering the holiday season – with 46.8% expecting better personal finances during the next 12 months, compared with 37.6% in Germany and 29.7% in France.

AI HAS A TRUST ISSUE

Americans are skeptical of the U.S. government’s current approach to AI regulations, based on our Harris Poll research with Collibra.

- 76% support federal regulations to oversee the technology’s evolution (75% for state regulations).

- The biggest threats Americans cite as necessitating AI regulation include privacy concerns (64%), safety and security risks (64%), misinformation (57%), and ethical use and accountability (57%).

- Among business decision-makers, 88% have “a lot” or a “great deal” of trust in their own companies’ approach to AI regulations.

- Decision-makers at large companies (87%) are more likely than those at small companies (55%) to trust AI today.

GEN Z UNWARE OF FOOD RECALLS

Young consumers who rely on social media for news are missing information on critical food recalls, according to our Harris Poll survey with Fast Company.

- Boomers were most likely to hear about food recalls in the past year (69%), followed by Gen X (52%), Millennials (39%) and Gen Z (26%).

- Millennials (47%) and Gen Z (42%) were far more likely to say they would avoid a retailer associated with a recall than Boomers (28%).

- 72% of consumers say they feel informed about the quality of the food they buy (64% for Gen Z and 76% for Boomers).

MYTHS AFFECT HOME-BUYING

Buying a home can be daunting, yet many misconceptions are causing unneeded fear, based on our Harris Poll study with KB Home.

- 54% of Americans believe mortgage rates are at an all-time high. (They’re not).

- 56% can identify the meaning of APR.

- 54% know what PMI is – with Gen Z and Millennials least likely.

- Only 36% know that a minimum down payment of 20% is not required to purchase a home.

- Only 28% know someone could qualify for a mortgage with a credit score in the 500s.

ICYMI

In case you missed it, check out the thought-leadership and happenings around Stagwell making news:

- Breaking down the Fall Out: Google Antitrust Ruling Impact

- 20 brands catching Baby Boomer’s attention right now

- Wendy’s wins over Gen Z with affordability…and chicken

- For many Americans, social security worries steer voting in presidential election

Related

Articles

In the News, Press Releases, Thought Leadership

Oct 30, 2024

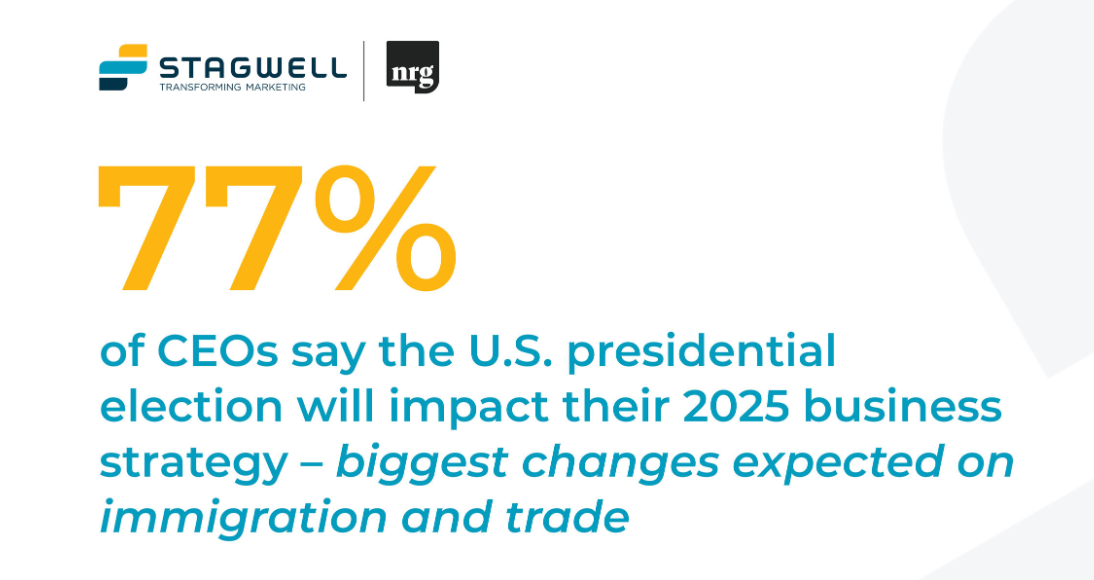

77% of CEOs Say the Election Will Impact their 2025 Business Strategy; 85% are Bullish on Investment in the Gulf Region, Reveals Stagwell (STGW) Survey

In the News, Press Releases, Talent & Awards

Sep 18, 2024

Stagwell (STGW) Appoints Sunil John as Senior Advisor, MENA, to Spearhead Regional Growth

Marketing Frontiers, Thought Leadership

Jul 26, 2024

Game On for In-Game Advertising? Four Things Marketers Should Know About Gaming

It's clear from dozens of Stagwell’s interviews with senior marketers…